Families, older and better-paid people now stuck renting, according to survey

The true extent of how Ireland's rental trap has snared aspiring homeowners is revealed today as just 15pc of current renters believe they can acquire a home within the next year.

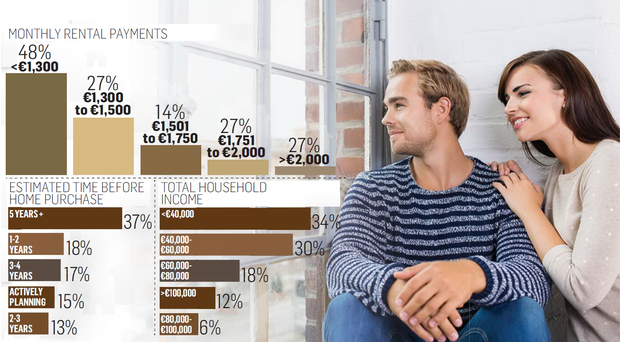

More than a third now believe it will be more than five years before they can manage to get on the property ladder.

This is even despite the fact that almost all renters are determined to get out of rental accommodation and to own their own home eventually (95pc), with just 5pc resigned to remaining in rental forever.

However, less than one third of current renters said that they could afford a deposit of more than €5,000. This compares with a deposit on an average new home in the capital which currently stands at €30,000 or higher.

The rental survey published today was commissioned by the Irish Independent through the Real Estate Alliance (REA) and taken from the opinions of more than 300 people currently renting in Dublin.

It shows that many are stuck unwillingly in rental accommodation even despite earning high salaries - more than a third of current renters are earning in excess of €60,000 per annum.

Renting is increasingly the lot of couples, with 57pc of all renters in the capital either married or living with a partner. Stock image

Two thirds (66.3pc) are earning more than €40,000, an income that in previous times would have got them on the housing ladder. However, in a 'Catch 22' situation, their saving abilities are being hampered by soaring rents.

Read More: A 'Rent to Buy' scheme could be a happy halfway house and give families security

More than half are now shelling out more than €1,300 per month in rent, with 27pc in the band between €1,300 and €1,500 and a further 14pc paying between €1,500 and €1,750.

And in a break with the Irish tradition of starting a family in the first-bought home, it emerges that 22.5pc of renters already have children.

Renting is increasingly the lot of couples, with 57pc of all renters in the capital either married or living with a partner.

Deposits are seen as the biggest obstacle, with almost half (48pc) citing the lack of funds for a deposit as a key barrier. After deposits, 29pc cite their earnings falling short as the main reason.

And an indicator of a possible solution to their woes might come in the form of a 'rent to buy' scheme, with an overwhelming 81pc of renters saying they would move into their ideal home today, within a commutable distance of Dublin, if they could rent the property for a few years before buying.

Rental certainty over a five-year period was the most important factor in making such a scheme work, with most people being prepared to pay a deposit to secure the right to buy after five years.

"This survey is a resounding statement that long-term rental is not what people want," said REA spokesperson Healy Hynes (right).

"Despite a demographic change towards families renting, it is clear it is not their desired long-term solution. Much has been made in the population figures of a shift from home ownership to rental. However, this is a response to the housing supply issue rather than a lifestyle decision," he said. "The fact that 37pc of renters feel they will not own a home within five years shows how the odds are stacked against them in the current climate where it is cheaper to pay a mortgage than to rent."

A person looking to buy a house at €250,000 (among the very cheapest in Dublin) must raise a deposit of at least €25,000, leaving them with a mortgage of €225,000 and average monthly repayments of €1,000.

However, this repayment is about €500 cheaper than the average rent being paid by the survey's respondents, meaning that they could save €6,000 per year by purchasing a house.

The majority of respondents are living in South Dublin (35pc) and the city centre (29pc), indicating that people may be renting where they want to eventually live, but are hamstrung by house prices and lending restrictions.

What was traditionally a large core of renters of student age is evaporating fast as those under 25 cannot afford to rent at all. The largest age group was in the 25 to 35 bracket (68pc) while there are also indications that the renting population is aging as more people remain priced out - 28pc are now 35 or older.

Tenants rate the ability to move again if their circumstances change and the fact that they are not responsible for maintenance as the two greatest attractions about renting.

However, one third feel that rent is wasted money.